China’s rare earth export strategy continues to cause long, unpredictable delays, and companies that depend on samarium cobalt (SmCo), neodymium iron boron (NdFeB), and other heavy-REE magnets should plan for ongoing disruption through 2026.

Why REE exports are still delayed

In 2025, China tightened export controls on several medium and heavy rare earth elements, bringing SmCo magnets, Dy/Tb-containing NdFeB magnets, and related alloys under a strict licensing system. Every shipment now needs a non-automatic export license, leading to longer reviews, heavier documentation, and broad supply bottlenecks.

Although the stated goals are national security and conservation of strategic materials, the process has become slow, opaque, and highly discretionary. Many applications sit for 60–120 days or longer without clear decisions, and a classification of “no rejection” often just means the application is on hold indefinitely.

2025: From new rules to real-world bottlenecks

In April 2025, MOFCOM Announcement No. 18 added seven medium and heavy rare earths and associated products to the restricted export list, reshaping how SmCo and certain NdFeB magnets move across borders. Local commerce bureaus initially floated a 45–60 day review window, but actual processing times soon exceeded those informal expectations.

By mid‑2025, delays were routine, especially for aerospace, medical, advanced controls, and sensor applications, or anything with perceived dual‑use potential. Additional MOFCOM announcements in October 2025 widened the scope again, adding more elements, some processing equipment, and even foreign‑made goods that contain Chinese-origin rare earth inputs.

Politics vs. policy: The “General License” that doesn’t exist

A high-profile U.S.–China meeting in November 2025 raised hopes by signaling intent to relax some controls and develop a General License for low‑risk commercial exports. On the ground, however, nothing has changed: there is no implementing rule, no Customs notice, and no provincial process to make a General License usable.

As of December 2025, exporters still work entirely on a case‑by‑case basis. A small number of large multinationals have obtained licenses for lower‑risk commercial shipments supported by strong end‑use documentation, but approvals remain rare, documentation-heavy, and unpredictable.

What this means for magnet users

For users of SmCo and heavy‑REE NdFeB magnets, the strictest constraints fall on the highest‑performance applications. Military‑adjacent, aerospace, and sophisticated sensor programs almost never receive approvals, and even commercial projects face intense scrutiny if documentation is weak or end‑use descriptions are unclear.

Regulators increasingly expect full visibility into the supply chain, from intermediate steps to final application. With no statutory review periods, there is still no reliable way to forecast export timing, and highly variable approval times are likely to continue well into 2026, particularly for heavy‑REE magnetic materials.

How Arnold is responding—and how to plan

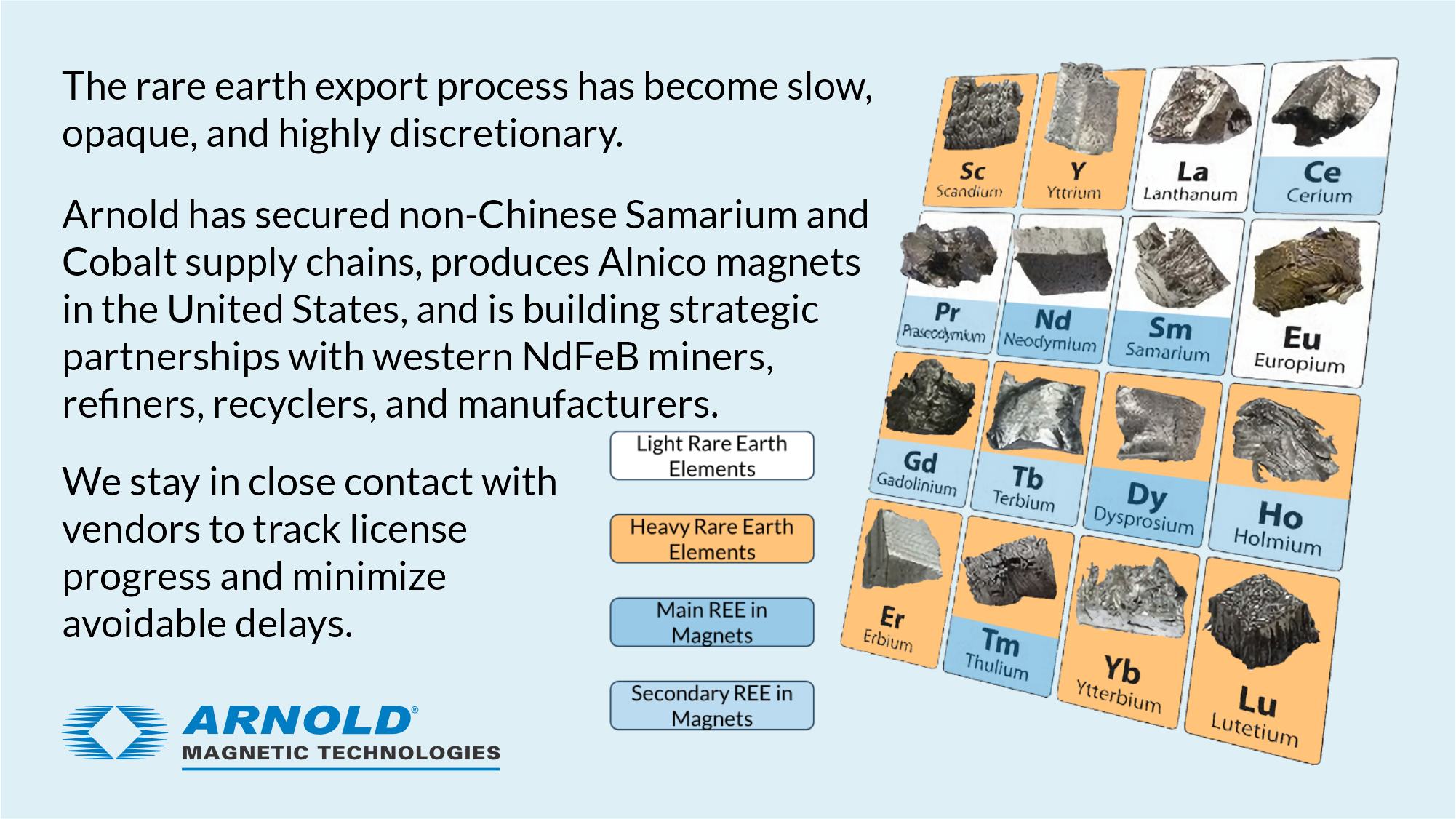

Arnold is concentrating on what it can directly influence. Arnold has secured non-Chinese Samarium and Cobalt supply chains in order to satisfy customer demand with SmCo manufacturing in Switzerland and in Thailand. Arnold also produces Alnico magnets in the United States with zero dependence upon China. Along with this Arnold is building strategic partnerships with western NdFeB miners, refiners and manufacturers. The company has upgraded its documentation practices to meet changing Chinese requirements, engages with customers early to gather needed application details, and stays in close contact with vendors to track license progress and minimize avoidable delays.

For customers, the planning focus should shift from “when will this license clear?” to “how can designs reduce exposure to the most constrained materials?” For applications that don’t require the extremely high heat tolerances of SmCo or strength of NdFeB, “rare-earth free” Alnico magnets may be adequate.

These strategies will not suit every program; many high‑end systems will still need heavy‑REE technologies. Arnold’s engineering team can help assess alternatives for current and future designs, aiming to lower supply‑chain risk while maintaining required magnetic and mechanical performance.

Conclusion

China’s heavy rare earth exports remain tightly controlled and hard to predict, despite talk of potential easing. Licenses often take more than three months and demand extensive, detailed paperwork.

Because decisions rest entirely with Chinese regulators, suppliers and buyers have little leverage to speed or influence outcomes, which can vary by province and product type. Organizations relying on heavy rare earths should assume ongoing delays and one‑off approvals rather than smooth, predictable flows, and Arnold will continue to share updates as the policy and export landscape evolves. Be sure to work with your local Arnold representatives who can help tailor solutions for your material needs without dependency upon Chinese Rae Earths.

Based in Rochester, NY with an operating history of over 130 years, Arnold is a leading global manufacturer of engineered solutions for a wide range of specialty applications and end-markets, including aerospace and defense, general industrial, motorsport, oil and gas, medical, and energy. From its Technology Center and manufacturing facilities located in the United States, the United Kingdom, Switzerland, Thailand, and China, the company produces engineered magnetic assemblies in addition to high-performance permanent magnets, precision foil products, and highly loaded composites that are mission critical in motors, generators, sensors, and other systems and components. Based on its long-term relationships, the company has built a diverse and blue-chip customer base totaling more than 2,000 clients worldwide. For more information on Arnold, visit https://www.arnoldmagnetics.com